Looking for the best online bank app in the UK in 2025? With digital banking now the norm, choosing the right app can make managing your money easier, smarter, and even a bit more fun.

Whether you want slick budgeting tools, instant notifications, or international money transfers, there’s an app for you. Let’s dive into what makes a great banking app, the top contenders this year, and how to pick the perfect one for your needs.

Why Online Banking Apps Matter in 2025

Banking apps have become essential tools for everyday money management. With features like instant spending notifications, easy bill splitting, and 24/7 support, these apps put your finances at your fingertips.

In 2025, user expectations are higher than ever-people want intuitive design, robust security, and innovative features like AI-powered budgeting and cardless cash withdrawals. The best online bank apps in the UK are leading the way with smart, user-friendly solutions.

What to Look for in the Best Online Bank App

Before we get to the top picks, here are some must-have features for any great UK banking app in 2025:

- Intuitive User Interface: Clean, easy-to-navigate design for quick access to your money.

- Biometric Security: Log in with fingerprint or face recognition for extra protection.

- Real-time Notifications: Instant alerts for spending, payments, or suspicious activity.

- AI-Powered Budgeting: Automated tools to track spending, categorize expenses, and suggest savings.

- International Capabilities: Low-fee transfers and multi-currency accounts for travel or sending money abroad.

- Card Control: Instantly freeze, unfreeze, or order new cards from the app.

- 24/7 Customer Support: In-app chat or phone support whenever you need help.

- Savings Pots & Goals: Create separate pots for holidays, bills, or rainy days and set targets.

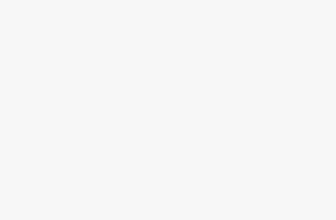

Best Online Bank Apps in the UK in 2025

Starling Bank

Summary

Starling is a top all-rounder, perfect for everyday banking and travel. Its app is user-friendly, offers strong security, and helps users manage their money effortlessly

Monzo BANK

Summary

Monzo stands out for its intuitive interface and innovative features like emoji payments and detailed spending reports. It’s ideal for those who want to take control of their finances and budget smarter.

Revolut BANK

Summary

Revolut is perfect for international users and travelers. It offers seamless currency exchange, low-fee transfers, and powerful financial tools in one app.

Chase Bank UK

Summary

Chase is great for those seeking rewards and investment options. Its cashback feature and easy-to-use savings tools make it a popular choice for everyday banking and growing your money.

Monese Bank

Summary

Monese is ideal for expats and those needing multi-currency support. Its credit builder and fast setup help users get started quickly and improve their credit scores.

Metro Bank

Summary

Metro Bank blends digital convenience with traditional banking. It’s a solid choice for users who value both online features and the option for face-to-face service.

Wise

Summary

Wise is perfect for frequent travelers or those sending money abroad. It offers transparent fees and real exchange rates, making international money management simple.

Lloyds Bank

Summary

Lloyds offers the reliability of a traditional bank with modern app features. It’s great for users who want trusted service and helpful financial insights.

Barclays

Summary

Barclays provides a robust, secure app with excellent support and a wide range of features for everyday banking needs.

Barclays

Summary

Barclays provides a robust, secure app with excellent support and a wide range of features for everyday banking needs.

HSBC UK

Summary

HSBC stands out for international customers and those needing global access. Its app is secure, easy to use, and packed with helpful tools for managing money worldwide.

List of Best Online Bank Apps in the UK (2025)

Here’s a rundown of the top online banking apps in the UK, based on features, ease of use, and customer reviews.

| App | Best For | Standout Features | Trustpilot/Review |

|---|---|---|---|

| Starling | All-rounder, everyday banking | 50+ spending categories, savings goals, cheque deposits, 24/7 support | 4.2 / #1 |

| Monzo | Budgeting, spending insights | Colourful UI, spending reports, pots, loans, cashback, investment options | 4.5 / #2 |

| Revolut | International, multi-currency | 29+ currencies, crypto, commodities, spending notifications, savings pots | 4.3 / #3 |

| Chase | Cashback, simple savings | 1% cashback, Nutmeg investments, round-ups, high interest on savings | 4.1 / #4 |

| Monese | Multiple currencies, credit building | Instant account setup, credit builder, multi-currency, budgeting tools | 4.2 / #10 |

| Lloyds Bank | Traditional banking, reliability | Budgeting, spending categorization, secure payments, in-app support | #4 |

A Closer Look at the Top Three

Starling Bank

- Consistently rated the best online bank app in the UK, Starling offers a feature-packed experience. You get instant notifications, powerful budgeting tools, digital cheque deposits, and the ability to create multiple savings goals. The app is intuitive and supports both personal and business accounts. Plus, you can freeze your card instantly and get help via 24/7 chat2.

Monzo

- Monzo stands out for its fun, user-friendly design and a wide array of features. It’s great for budgeting, with detailed spending reports, customizable pots, and real-time insights. Monzo also offers loans, cashback, investment accounts, and even mortgages-all managed from the app. It’s an excellent choice for anyone who wants to make managing money simple and engaging2.

Revolut

- If you travel often or need to manage money in different currencies, Revolut is a top pick. The app supports spending and transfers in over 29 currencies, plus access to crypto and commodities. You can set budgets, get instant spending notifications, and even invest-all from your phone. Revolut’s international focus and flexible features make it a favorite for globetrotters and freelancers12.

Innovative Features to Watch in 2025

The best online bank apps in the UK are pushing boundaries with these cutting-edge features3:

- AI-Powered Personal Finance: Apps now analyze your spending and offer personalized tips to save more.

- Cardless Cash Withdrawal: Withdraw cash from ATMs using just your phone-no card needed.

- Voice-Activated Banking: Use voice commands to check balances or make payments hands-free.

- Virtual Cards: Instantly generate digital debit or credit cards for secure online shopping.

- Expense Categorization: Automatic sorting of your spending helps you see where your money goes at a glance.

How to Choose the Best Online Bank App for You

With so many great options, how do you pick the best online bank app in the UK for your needs? Here are some tips:

- Think about your lifestyle: Do you travel a lot? Need help with budgeting? Want to invest or save for a big goal?

- Check fees and perks: Most challenger banks offer free accounts, but look for added perks like cashback or higher interest on savings.

- Read reviews: Trustpilot ratings and app store reviews can give you real user feedback on reliability and support12.

- Test the interface: Download a few apps and see which one feels easiest and most enjoyable to use.

Summary: The Future of Banking is in Your Pocket

In 2025, the best online bank app in the UK is the one that fits your lifestyle, keeps your money secure, and helps you reach your financial goals. Starling, Monzo, and Revolut are leading the way with innovative features, intuitive design, and top-notch customer support. As banking apps continue to evolve, expect even smarter tools, more personalization, and seamless experiences.

Ready to take control of your money? Download one of these top online bank apps and experience the future of banking today!